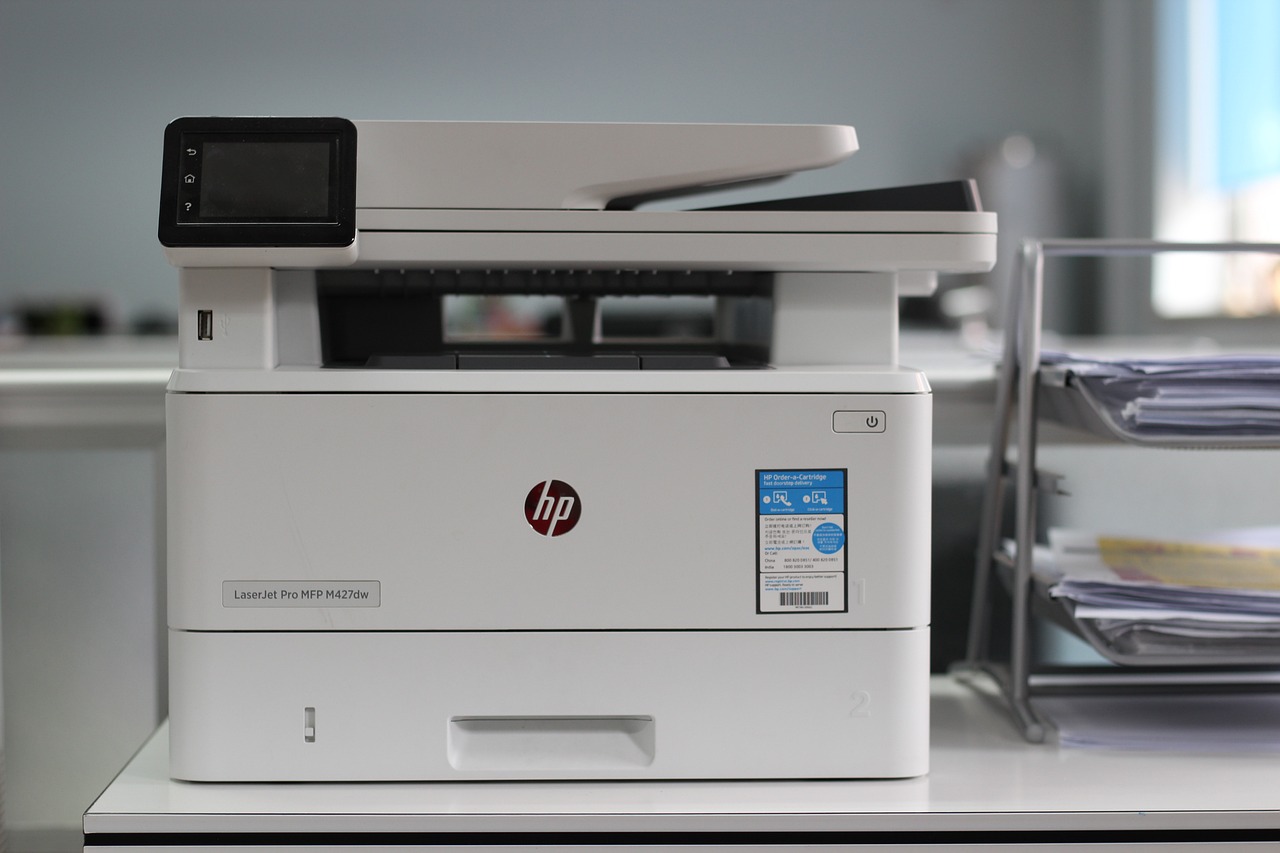

Did you know that small businesses often spend up to 3% of their annual revenue on printing costs alone, printer leasing, printer leases, office printer lease contracts, and multifunction printers? If you’re a small business owner looking to optimize your office copier solutions, transitioning from leasing to buying could be the game-changer you need. In this guide, we will explore the benefits and considerations of making this shift, helping you make an informed decision tailored to your business needs.

Benefits Of Leasing Copiers

Cost Savings

Leasing copiers can save money with lower upfront costs compared to buying outright. Total costs over the equipment’s lifespan may be lower with leasing than purchasing. Tax benefits from leasing payments can be deductible expenses for businesses.

Maintenance And Support

Leasing agreements often include comprehensive maintenance, relieving owners of repair costs. Support services are typically readily available for leased copiers. Maintenance responsibilities are simplified with leasing compared to ownership.

Flexibility

Leasing provides flexibility for upgrading or changing copier equipment as needed. Businesses can adapt easily to changing requirements without long-term commitments. Lease terms can be adjusted based on business growth or changes.

Upgrading Options

At the end of a lease, various upgrade paths are available for copier equipment. Leasing allows access to cutting-edge technology, enhancing productivity. Frequent upgrades through leasing can boost efficiency and productivity levels.

Pros And Cons Of Buying Copiers

Long-Term Savings

When you purchase a copier, you can enjoy significant long-term savings compared to continuous leasing. After the initial copier leasing purchase period, costs typically decrease as you eliminate ongoing lease payments. Owning the equipment outright ensures that you only pay for maintenance and supplies, leading to substantial savings in the long run.

Full Ownership

Full ownership of a copier provides numerous benefits once a lease term ends. By owning the copier outright, you have complete control over the asset and can manage it according to your business needs. The freedom to modify or sell the copier without restrictions gives you flexibility in adapting to changing requirements.

Maintenance Costs

When considering maintenance costs, owning a copier may involve higher expenses compared to leasing due to unpredictable repair costs. However, leasing agreements often include service agreements that mitigate unexpected expenses. Evaluating both options is crucial to determine the most cost-effective solution for your business.

Pros Of Buying Copiers:

- Long-term savings potential

- Full control and ownership benefits

- Flexibility in managing and modifying equipment

Cons Of Buying Copiers:

- Higher initial investment

- Potential for increased maintenance costs

Depreciation

The value of owned copiers tends to depreciate over time, impacting financial statements and tax filings. Managing depreciation can be complex for owned equipment but is generally avoided when leasing copiers. Leasing offers a straightforward solution by allowing you to upgrade to newer models without worrying about depreciation.

Key Differences Between Leasing And Buying

Initial Costs

When comparing leasing and buying copiers, the initial costs play a crucial role. Leasing typically involves lower upfront payments, reducing the financial burden on small businesses. This can be beneficial for companies with limited capital resources. On the other hand, purchasing a copier outright requires a significant initial investment, impacting cash flow in the short term.

- Leasing: Lower initial costs

- Buying: Higher upfront investment

- Impact On Cash Flow: Leasing reduces immediate financial strain

Monthly Payments

In terms of monthly payments, leasing agreements offer a structured payment plan that includes maintenance and service costs. This predictable expense model aids small businesses in budgeting effectively. Conversely, financing a purchase results in variable monthly payments based on interest rates and loan terms.

- Leasing: Structured monthly payments

- Financing Purchase: Variable monthly obligations

- Budgeting Aid: Predictable expenses for leased copiers

Ownership And Control

The distinction between ownership and control is significant when considering copier solutions. Businesses that own their equipment have full control over its usage and maintenance. In contrast, leased copiers provide operational control but limit customization options. Ownership influences decision-making related to repairs, upgrades, and modifications.

- Owned Equipment: Full control over usage

- Leased Copiers: Limited customization abilities

- Decision-Making Influence: Ownership impacts equipment management

Technology Upgrades

Staying current with technological advancements is crucial for small businesses seeking operational efficiency. Leasing copiers allows for regular upgrades to newer models without the hassle of selling outdated equipment. Technological improvements directly impact productivity levels and streamline workflow processes.

- Technological Advancements: Importance of staying updated

- Leasing Benefits: Facilitates regular upgrades

- Operational Efficiency: Technology’s impact on productivity

Types Of Copier Leases

FMV Lease

An FMV lease, also known as a Fair Market Value lease, allows businesses to lease copiers at a monthly rate based on the equipment’s expected value at the end of the term. This flexible arrangement enables companies to upgrade to newer models easily. The benefits of an FMV lease include lower monthly payments and the ability to return or purchase the copier at fair market value at the end of the lease.

At the end of an FMV lease term, businesses have the flexibility to either return the copier, purchase it at its fair market value, or negotiate a new lease agreement. This option is attractive for small businesses seeking up-to-date technology without committing to ownership. By providing this choice, FMV leases empower businesses to adapt to changing needs and technological advancements efficiently.

FMV leases can be financially advantageous for small businesses looking to manage costs effectively. With lower monthly payments compared to purchasing outright, companies can allocate funds strategically. The potential for tax deductions on lease payments further enhances the financial benefits of choosing an FMV lease.

$1.00 Buyout Lease

A $1.00 buyout lease, also known as a capital lease, offers businesses the opportunity to own the copier at the end of the lease term by making a nominal payment of $1. This structure provides companies with ownership of the equipment while spreading out costs over time. The benefits of a $1.00 buyout lease include long-term cost savings through ownership and control over the copier’s usage.

Choosing a $1.00 buyout lease leads to ownership at a minimal cost, making it a desirable option for businesses aiming to secure assets in the long run. By paying only $1 at the end of the term, companies can acquire the copier outright without substantial upfront expenses. This approach aligns with small businesses’ goals of building equity in their assets gradually.

The financial implications of higher monthly payments in a $1.00 buyout lease versus ownership need careful consideration. While monthly payments may be higher than other lease options, owning the copier outright at the end of the term can result in significant cost savings over time. Businesses must weigh these factors when deciding between higher monthly payments and eventual ownership.

Lease Terms

36-Month Lease

A 36-month lease offers small businesses advantages such as staying current with rapidly changing technology and ensuring operational efficiency. This shorter term provides flexibility for upgrading copiers as needed, keeping pace with evolving business requirements. With frequent upgrades available, companies can optimize productivity while managing costs effectively.

48-Month Lease

A 48-month lease strikes a balance between cost-effectiveness and flexibility, accommodating moderate technological advancements during the term. This duration allows businesses to leverage updated features without committing to longer contracts, offering a practical solution for maintaining operational efficiency. The manageable monthly payments over four years make this option appealing for budget-conscious organizations.

60-Month Lease

Opting for a 60-month lease can benefit small businesses seeking lower monthly payments over an extended period. While this commitment offers financial relief in terms of cash flow, it may limit opportunities for frequent upgrades due to the longer term length. Companies with stable needs and budget constraints may find this option suitable for maintaining copier functionality without incurring high upfront costs.

Factors To Consider When Choosing Copiers

Volume Needs

When selecting copiers, assess the print volumes your business requires to ensure efficiency and cost-effectiveness. Different lease options can cater to varying print volumes, offering flexibility in meeting fluctuating demands. Matching copier capabilities with business needs is crucial for optimal performance.

Leasing or owning a copier depends on your business’s volume needs. High-volume requirements may make ownership more cost-effective in the long run, considering the potential savings compared to continuous leasing expenses.

Technology Requirements

To choose the right copier, identify specific technology requirements aligned with your business operations. Leasing can provide access to advanced features without the upfront cost of ownership, allowing small businesses to benefit from cutting-edge technology within budget constraints.

Aligning copier technology with business goals is essential for enhancing productivity and efficiency. By leasing, businesses can stay updated with the latest technological advancements without committing to long-term ownership.

Financial Implications

When deciding between leasing and buying a copier, it is crucial to analyze the overall financial impact. Leasing offers lower initial costs and predictable monthly payments, which is ideal for businesses managing cash flow effectively. Buying a copier involves a higher upfront investment but may result in long-term cost savings.

Cash flow considerations play a significant role in the decision-making process. Leasing spreads out costs over time, easing financial strain on small businesses compared to a substantial one-time purchase expense.

Special Requirements

Consider any unique needs that could influence your decision between leasing and purchasing a copier. Specialized features, such as scanning capabilities or document finishing options, can significantly impact the choice of copier solutions based on your business’s specific requirements.

Customizing equipment to meet specific business goals is essential for maximizing operational efficiency. Whether through leasing or buying, ensuring that the copier aligns with your business’s unique needs is key to achieving optimal results.

Assessing Copier Needs

Monthly Volume

Assess your expected monthly volume to make informed decisions on leasing or buying a copier. Consider how the monthly volume impacts your choice, ensuring it aligns with your business’s printing demands. Leasing offers flexibility to adjust to fluctuations in monthly printing requirements.

Color VS. Black And White

Compare the cost and functionality differences between color and black-and-white copiers. Your choice between color and monochrome affects leasing options, impacting upfront costs and long-term expenses. Consider how color printing influences your overall copier solution.

Speed Requirements

Identify the speed requirements essential for your business operations when selecting a copier. Leasing enables access to faster models without significant initial investments, enhancing your operational efficiency. Evaluate how speed impacts productivity and workflow within your organization.

Additional Features

Evaluate the significance of additional features like scanning, faxing, and finishing options in a copier. Leasing provides access to multifunctional devices that cater to various business needs efficiently. Specific features can significantly enhance your overall business operations.

Understanding Lease Terms And Rates

Lease Rate Factor

The lease rate factor represents the interest rate used in calculating lease payments. It plays a crucial role in determining the total amount you pay over the lease term. By evaluating this factor, small businesses can compare different lease options effectively. Understanding the lease rate factor is essential as it directly impacts monthly payments and overall affordability.

Interest Rate Interest rates significantly influence the total cost of leasing compared to purchasing a copier. Small businesses must grasp how interest rates affect their financial commitments before deciding between leasing and buying. Being aware of interest rates is vital for effective financial planning and budgeting. Fluctuations in interest rates can have long-term implications on lease agreements, affecting costs over time.

Common Terms In leasing agreements, various common terms are used that may be unfamiliar to small business owners. It is crucial to understand terms like residual value, maintenance fees, and escalation clauses to navigate lease agreements confidently. Clarity in lease contracts is paramount for small businesses to avoid misunderstandings or unexpected charges. Familiarity with leasing terminology empowers businesses during negotiations, ensuring favorable terms and conditions.

Steps To Transition From Leasing To Buying

Assess Current Needs

Businesses should assess their current and future copier needs by considering factors like volume and features. Understanding operational requirements is crucial as it helps in making an informed decision regarding leasing or purchasing. A thorough assessment ensures that businesses make choices that align with their specific needs and budget.

Evaluate Costs

It’s essential to evaluate all associated costs, including maintenance, supplies, and potential repairs, before deciding. Hidden costs can significantly impact the overall financial health of a business, so a comprehensive cost analysis is necessary. By conducting a detailed evaluation of costs, businesses can make a well-informed decision that considers all financial implications.

Understand Lease Terms

Thoroughly understanding lease terms before signing is crucial to avoid any surprises or hidden fees later on. Common pitfalls in lease agreements include escalating payments, maintenance responsibilities, and early termination penalties. Clear comprehension of lease terms can prevent misunderstandings and legal complications down the line.

Plan For Ownership

Businesses opting for leasing should plan for eventual ownership by considering buyout options or upgrade possibilities. Considering long-term goals when entering into a lease agreement can help in making strategic decisions. Planning for ownership from the outset can also influence lease negotiations, leading to more favorable terms.

Evaluating Costs Of Ownership

Initial Purchase Price

When deciding to lease or buy a copier, the initial purchase price plays a crucial role. It directly impacts the business’s financial decision-making process. Businesses must consider how this cost aligns with their budget and long-term financial goals. Different pricing strategies can also influence the overall financial planning, affecting cash flow management significantly.

Pros:

- Allows businesses to own the equipment outright.

- Potential tax benefits from depreciation deductions.

Cons:

- Higher upfront costs compared to leasing.

- Requires a larger initial investment, impacting short-term cash flow.

Ongoing Maintenance Costs

Considering ongoing maintenance costs is vital when choosing between leasing and ownership. These costs can vary significantly between the two options. While leasing agreements often cover maintenance expenses, owning equipment may lead to unexpected maintenance costs, potentially impacting the business’s bottom line.

Pros:

- Greater control over maintenance schedules and quality.

- Flexibility to choose service providers based on specific needs.

Cons:

- Responsibility for all maintenance expenses falls on the business owner.

- Risk of incurring high costs for repairs and replacements.

Closing Thoughts

In the journey from leasing to buying copiers for your small business, you’ve explored the advantages of both options, weighed their pros and cons, and delved into the nuances that differentiate them. Understanding your copier needs, evaluating costs, and grasping lease terms are crucial steps in making an informed decision. As you navigate this process, remember that what works best for one business may not be ideal for another. Your unique requirements and financial considerations should guide your choice between leasing and buying copiers.

Consider seeking expert advice tailored to your specific situation before making a decision. With a clear understanding of your needs and the available options, you can confidently select a copier solution that aligns with your business goals. Take charge of this essential aspect of your operations to enhance efficiency and productivity. Your copier solution plays a vital role in supporting your daily workflow, so make a choice that sets your business up for success.

Frequently Asked Questions

1. What Are The Advantages Of Leasing Copiers For Small Businesses?

Leasing copiers offers lower upfront costs, access to advanced technology, maintenance services included, and potential tax benefits for small businesses.

2. What Factors Should Small Businesses Consider When Choosing Between Leasing And Buying Copiers?

Small businesses should consider factors like budget constraints, technological requirements, maintenance needs, scalability, and long-term cost implications when deciding between leasing and buying copiers.

3. How Can Small Businesses Assess Their Copier Needs Effectively?

Small businesses can assess their copier needs by evaluating print volume, required features (color printing, scanning), network compatibility, workflow integration, and future growth projections.

4. What Key Aspects Of Lease Terms And Rates Should Small Businesses Understand Before Committing To A Copier Lease?

Small businesses should understand lease duration, monthly payments, end-of-lease options (buyout or return), penalties for early termination, maintenance coverage, and potential upgrades during the lease period.

5. What Steps Should Small Businesses Follow When Transitioning From Leasing To Buying Copiers?

Small businesses should evaluate current usage patterns, review ownership costs versus leasing expenses, research available models in the market, negotiate purchase terms with vendors, and plan for seamless integration of the new copier.

Optimize Your Small Business With Premier Copier Solutions In Concord, California!

Are you searching for reliable copier solutions near Concord, California? Look no further! At Office Machine Specialists, we’ve been the go-to experts in servicing and selling top-notch office equipment since 1995. As a trusted family-run business, we’re committed to providing you with the best equipment options and exceptional after-sales service.

With decades of experience, we understand that selecting the right copier solutions can be overwhelming. That’s where we come in. Our knowledgeable team will ask the right questions, understand your unique requirements, and guide you toward making smart decisions for your business. Whether you’re looking to lease or purchase a copier, we’ve got you covered.

We’ve witnessed the evolution of office equipment from the pre-internet era to the cutting-edge digital workflow environment. Our expertise spans efficient copier solutions, seamless document management, advanced account control, and fleet management. Our extensive experience with all the major brands makes us the invaluable resource your organization needs.

Don’t settle for anything less than the best. Contact Office Machine Specialists today for all your copier solution needs. Let us help you streamline your office operations and elevate your business productivity to new heights!